Digital disruption: The music industry

Author: Anand Divekar

Disruption is increasingly in the news these days, usually in the context of a Silicon Valley company with a new business model and/or a new technology. With technology now permeating every industry, disruption outside Silicon Valley is accelerating and changing customer expectations as well as C-level/boardroom conversations.

Definitions

“Business Disruption is a radical change in an industry, business strategy, etc., especially involving the introduction of a new product or service that creates a new market.” (Dictionary.com)

“A Disruptive Innovation is an innovation that creates a new market and value network and eventually disrupts an existing market and value network, displacing established market leading firms, products and alliances.” Clayton Christensen (Wikipedia)

This article is a case study on the music industry and a portion of its partner ecosystem, viz. streaming providers such as Spotify, Apple and Google. It highlights events which have helped shape the industry into its current form via a series of transformative disruptions. The vulnerabilities/threats contributing to disruption are identified in boxes throughout the article. Potential avenues to recovery are also discussed. The article has valuable lessons for the content industry and other industries.

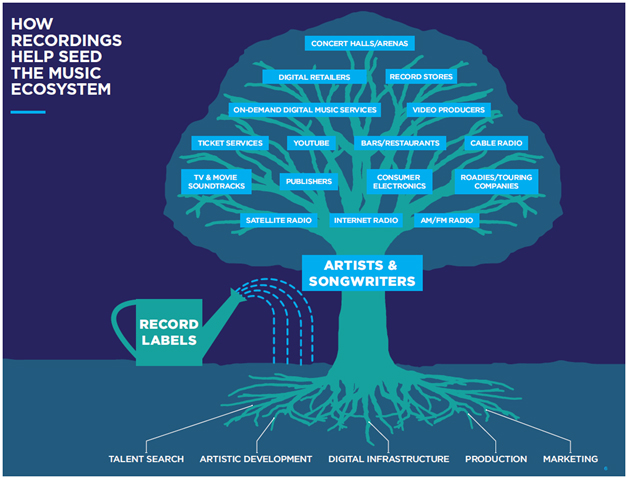

A recent New York Times article (March 24, 2016) on the recorded music industry in the US highlights a precipitous revenue drop, from nearly $12 Billion in 2006 to about $7 Billion in 2015 (figure below). At a macro level, the figure shows revenue from digital media growing steadily, while revenue from physical media plummeted (through 2010) before leveling off. CD-based revenues continued to drop in 2015 while vinyl saw an upswing, likely to be temporary.

Figure 1: Revenue trends, music industry

Note: Vulnerabilities/threats contributing to disruption are identified in boxes below throughout the article in large font.

A history of technology driven disruptions

Shaping consumer culture: tape recorders, radio and piracy

In the 1960’s, consumer electronics manufacturers triggered a surge of consumer spending with the introduction of audio tape and video recorders. Later, mobile products such as the Walkman, in-dash tape players in autos, the camcorder and other portable devices drove another wave of consumer spending.

Collecting, browsing and sharing objects of interest are fundamental characteristics of human behavior in a variety of domains including photography, art, music and video. By building products and markets which strengthened these basic behavioral patterns, manufacturers were already shaping consumer expectations. By the early 1990’s (when the internet was commercialized), consumers expected to be able to copy, carry and share music and video with them when they moved around for work or leisure.

Threat: Pre-existing customer expectations

CONSUMER EXPECTATIONS WHICH HAVE ALREADY BEEN SHAPED BY LONG TERM BEHAVIORAL REINFORCEMENT CAN BE VERY DIFFICULT TO CHANGE.

Disregarding copyright protection became a part of mainstream thinking and persisted even after the 1992 passage of the Audio Home Recording Act (AHRA). In a 2003 Pew Report study, 67% of Internet users said they did not care whether the music they downloaded was copyrighted.

The growth of piracy: CDs, file sharing and Napster

The CD was introduced in the early 1980s and consisted of a digital music format in which songs were stored as individual, unprotected files with significantly improved sound quality (compared to vinyl). The assumption was that these files were safe since no existing device was capable of copying them. Unfortunately, IBM launched the PC the year after the CD made its debut. Even then, with limited disk space (10MB) on a PC, copying files from a 700MB CD was impractical given the cost of disk space.

Threat: Customers, prevented from using a product as they want to, will look for workarounds

RESTRICTING CUSTOMERS FROM ACCESSING PRODUCT FEATURES BASED ON EXISTING TECHNOLOGY LIMITATIONS WILL ONLY LAST UNTIL SOMEONE CREATES TECHNOLOGY TO OVERCOME THOSE LIMITATIONS.

Storage costs continued to shrink over time. In 1995, with the unintentional public release of the MP3 format as freeware for audio file compression and the introduction of recordable CD drives for PC’s, copying, compressing and sharing music files became a reality. CD’s became susceptible to ripping, burning and file-sharing, leading to growing market demand for downloaded music. Consumers flocked to file-sharing services such as Napster.

With growing piracy driving concerns about lost revenue and with the industry intent on damage control, the RIAA spent millions of dollars from 2003 to 2008, suing or threatening up to 30,000 individuals as well as successfully litigating against companies like Napster (shut down in 2001) and Verizon (forced by a 2003 court order to disclose the identity of customers whose IP addresses were linked by the RIAA to piracy). Unfortunately, the impact on piracy in the mass market was minimal.

With Napster gone, other illegal file sharing services started sprouting up. As a result, the industry decided to make its first attempt at vertical integration in 2002 by offering a legal alternative to consumers with its own subscription services – MusicNet (started by Warner Music, Bertelsmann and EMI) and Pressplay (started by Universal Music Group and Sony Music). Both failed within a few years with bad reviews due to limited music choices, restrictive rules on downloads, confusing subscription packages and pricing, inadequate user interfaces, online ads, etc. Unfortunately, the learnings from those experiences were not used to create an improved service. With the risks overshadowing benefits, the founders bailed out.

The onset of disruption: iTunes and unbundling

In 2003, Apple’s Steve Jobs proposed a solution. iTunes, a music store would allow customers to download DRM-protected (digital rights management) music for playback on their Macintosh computers and iPods. A key aspect of the Apple proposal was to unbundle the songs in an album. Singles would be priced at 99c and albums would be priced at $9.99. Music executives, already under pressure from their recent problems at MusicNet and PressPlay, decided to experiment and move forward with a limited release for Apple Mac customers.

Threat: Bundled products force customers to ‘overspend’ on unwanted features

BUNDLED PRODUCTS FORCE CUSTOMERS TO OVERSPEND ON UNWANTED FEATURES AND CREATE A VULNERABILITY WHICH DISRUPTORS CAN TARGET. BUNDLING MAY INFLATE SHORT-TERM REVENUES BUT DOES NOT REFLECT TRUE DEMAND OR MARKET SIZE.

It is unclear whether music executives realized the magnitude of the potential consequences of unbundling, a change which was destined to disrupt the industry by challenging the fundamental cost of its production process. Prior to 2003, albums had a fixed price of around $15, even though most albums only contained 2 or 3 popular songs. Consequently, the industry had the luxury for many years of operating a high-cost production model, because album pricing supported it. That would change after iTunes went online.

The demand for unbundled music was undeniable – iTunes sold 1 million downloads in the first week after unbundling, and Apple sold its 1 millionth iPod in the following month. Within five months, iTunes was launched on the Windows platform to address demand. The impact of unbundling became increasingly obvious as consumer demand unexpectedly pivoted from the purchase of albums to purchase of individual songs. As album sales and revenues shrank, the market fragmented into numerous market segments which were impossible for record labels to target with physical product formats (vinyl and CD).

Threat: Inability to address market segments with appropriate products

ABILITY AND AGILITY ARE CRITICAL TO CUSTOMER RETENTION & GROWTH WHEN IT COMES TO IDENTIFYING AND TARGETING MARKET SEGMENTS WITH RELEVANT PRODUCT OFFERINGS, PRICING AND CUSTOMER EXPERIENCES.

Soon, the operating model became unsustainable, forcing many record labels to shut down. By 2009, DRM was eliminated enabling customers to play their iTunes music on any device of their choosing.

Statistics on the impact of unbundling: During the 80’s, 84 albums sold more than 5 million copies, and 19 albums sold more than 10 million copies each. By contrast, in 2011, only 3 albums sold more than 2 million copies each.Over time, even the most successful artists and record labels saw album sales plummet to a fraction of the volume in prior years. (Forbes)

Download revenues continued to grow through the 2012-2013 time frame before they peaked. iTunes was being disrupted by a new technology – streaming, which had come of age.

Streaming disrupts downloads; Apple plays catchup

Streaming providers started entering the market in 2005 with a customer value proposition which improved on music downloads. The streaming model provides unlimited shelf space, virtual inventory and no returns are ever necessary. The vast choices offered to customers do not consume any disk space on a user device (due to cloud storage) and can be rapidly modified to offer new services and content. Services are available 24×7 and can scale quickly to adjust to demand fluctuations. It offers instantaneous playback, well-designed user interfaces, and simple, ‘all you can eat’ monthly subscription plans. Songs can be curated into a myriad of generic and user customizable playlists to manage favorites, social sharing, discovery via genre, etc.

Surprisingly, Apple did not counter this threat to iTunes business until 2015, when Spotify’s revenues exceeded those of iTunes. The box below highlights this missed threat.

Threat: Inability to detect potential disruptors, assess their value propositions and act decisively to counter disruption

INCUMBENTS MUST MONITOR COMPETITORS GAINING TRACTION (PARAMETERS: CUSTOMERS, REVENUES, MAJOR INVESTORS, ETC.). DIFFERENTIATORS SUCH AS CUSTOMER BENEFITS, PRICING AND TECHNOLOGY MUST BE PERIODICALLY ASSESSED TO GAUGE THE RISK OF MARGINALIZATION OF THE EXISTING VALUE PROPOSITION..

The launch of Android smartphones, iPhones and tablets in 2007-2008 with improved data speeds and the availability of streaming music apps enabled customer mobility, accelerating adoption of streaming (as well as downloads). Along the way, streaming companies built troves of customer data, including geographic locations, music tastes and preferences, social networks, etc. which they used to improve backend software for data analytics, automated playlist curation and marketing to social connections. Although well-known artists drove the majority of usage, the creation of curated playlists for discovery enabled relatively unknown artists to get exposure to listeners and the opportunity to build a following.

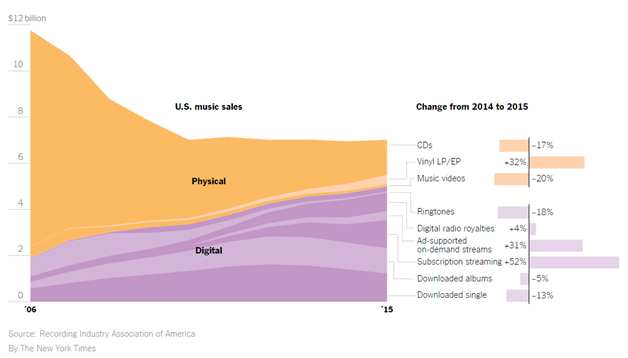

Streaming also contributed to significant drops in piracy, per 2012 research by the NPD Group, as consumers converted to free, legal services. In 2015, streaming revenues (paid and ad-supported) exceeded download revenues (2015 RIAA report) as shown in Figure 2A (below). Streaming revenues are shown in Fig. 2B. Streaming is now widely expected to be the dominant format in the future.

Note: SoundExchange is a company which administers statutory licenses, which allow services/organizations (such as ASCAP, BMI and SESAC which pay royalties for songwriting, publishing and composition) to stream artistic content while paying a fixed rate for each play. Royalties for downloads (iTunes) and streaming services (like Spotify) are outside its scope.

Ecosystem dynamics – partners and revenue models

Future disruptions are inevitable as business and technology models continue to evolve. The ecosystem described below is in a constant state of change as ecosystem partners compete with each other for market share and the industry struggles to maintain and grow its revenues based on its partner’s operating models and revenues.

The industry needs its technology partners (but all is not well)

The music industry has historically focused on artistic creativity (with a couple of forays into the world of download services ending in failure in the 2005 timeframe). Partners like Apple, Spotify and Google (YouTube) now fill a major void in delivering a high quality music experience to consumers. Partner creativity, engineering talent, market reach and risk taking in building new services and markets have been critical for industry success, but have also raised new challenges. For example, the industry has little control over reduced revenues due to ad supported subscriptions, marketing campaign discounts, the proliferation of illegal copies posted by music fans on YouTube, or the ability to monitor market and subscriber data (unless partners are contractually obligated to provide this data).

Streaming companies are simultaneously in a battle to establish market dominance based on the number of subscribers and revenues. Subscriber growth based on the ad-supported model can mean higher valuations, so there is incentive to grow this model. Spotify crossed the 100 million subscriber mark in June 2016, but has only 30% paid subscribers. As the company readies plans to go public (in the next 2 years), its valuation ($8.5 Billion in June 2015) could exceed $10 Billion, with no benefits accruing to artists (although record labels Sony BMG, Universal Music, Warner Music & EMI are investors). Spotify is working on reducing its cost base of which the largest item (55% of sales revenues) is due to music licensing deals with the industry. This negotiation is doubtless going to be a difficult one.

The value of music: pricing models and subscriber growth

THE PAID MODEL

Monthly subscription charges at Spotify and Apple Music range from $10 (single user) to $15 (family plan for up to 6 users) per month. Apple Music has gained substantial traction with 10 million paid users (and no ad-supported users) since it started in June 2015 and being cash-rich, can afford to be patient.

Consumers remain highly sensitive to recurring payments for entertainment products. With several competing providers in the market, price elasticity to demand is highly elastic (price increases cause subscriptions to drop rapidly) and prevents companies from raising paid subscription rates.

An example of price elasticity can be seen in the July 2016 experience at Netflix when 500,000 subscribers canceled service after monthly subscription rates were raised by $2 from $7.99 to $9.99, causing company stock to plummet overnight (Forbes).

THE AD-SUPPORTED MODEL

The ad-supported model on YouTube, Spotify and Pandora has resulted in the world being flooded with free music, drawing complaints from artists and the industry. 70% of Spotify’s more than 100 million subscribers, and YouTube’s entire subscriber base of over a billion subscribers (about one-third of all people on the internet of whom 80% are outside the US) subscribe to the ad-supported model. Pandora, another ad-supported company has experienced a pattern of shrinking revenues and subscriber bases and is likely to be sold. Apple Music does not offer the ad-supported model.

Ad-supported revenues depend on massive growth in subscriber numbers (for profitability) which drives commoditization of the music and may necessitate external money supply to survive revenue shortfalls or shrinkage. These revenues are volatile and significantly smaller than paid revenues (Figure 2B) partly due to fluctuating economic pressures facing advertisers.

Threat: Customer segments cross subsidizing each other can drive vulnerability in the business model

WHEN CUSTOMER GROUPS CROSS-SUBSIDIZE EACH OTHER, REVENUE STABILITY CAN BE AT RISK IN THE EVENT OF A RECESSION, ABRUPT CUSTOMER DEPARTURES, ETC. EXTERNAL FUNDING MAY BE KEY TO SURVIVAL UNDER SUCH CIRCUMSTANCES..

Paid subscribers tend to subsidize ad-supported subscribers (at Spotify). Revenues may be at risk in certain scenarios – for e.g. if paid subscribers switch to the ad-supported model in a recession.

Revenue growth in the future

Ongoing activities to improve revenue

The ongoing initiatives below in the industry could contribute to near term changes in revenue if they are successfully implemented.

DMCA-RELATED NEGOTIATIONS WITH GOOGLE

In 2016, the RIAA filed a court case against Google’s YouTube to permanently prevent illegal uploads of pirated music videos, an activity which Google currently has no liability for per the protection offered by the Safe Harbor clause in the DMCA (Digital Millennium Copyright Act, enacted in 1998). Today, the music industry is required to issue a manual request for take down of every instance of an illegal copy – an expensive exercise costing the industry millions of dollars, given the proliferation of illegal copies.

If the RIAA is successful, it will enable the industry to curtail annual revenue losses from unauthorized copies (of music and videos) and simultaneously save money by eliminating the existing and expensive ‘notice and take down’ process for each pirated copy.

SUBSCRIPTION PRICING AND SUBSCRIBER GROWTH

The industry is negotiating with Google and Spotify to increase revenues from the ad-supported model, by more rapidly converting subscribers to the paid model and/or increasing ad rates. Google and Spotify remain convinced that a key factor to increasing gross revenues is via growth of their subscriber bases, rather than making changes to the existing ad-supported models. That growth is increasingly dependent on subscriber growth in other countries some of which still have challenges with sketchy internet access.

An important question with ramifications for investment valuations and funding is whether the music ecosystem has reached its maximum market size and what can be done to grow it. Market analysis can answer this question. Take Spotify for example. Conducting market surveys and working with focus groups to create personas and psychographic profiles can offer a better understanding of current and new subscriber bases and helps assess the sensitivity of demographic groups to pricing models (ad-supported versus paid) and price changes. This knowledge can help redesign marketing offers to add new subscribers and nudge existing ad-supported customers into the paid category. It could also lay the groundwork for introduction of new services as new technologies become commercially available.

TRANSPARENCY WITH PAYMENTS

A lack of transparency around payments by partners to the industry and artists has created a trust issue, with an estimated 20 to 50% of royalty payments not reaching the correct recipients. Revenue receipts, the calculation of revenue splits and commissions and issuance of final payments to artists are currently areas of deficiency.

Disruptive threat to the ecosystem

A LACK OF INFORMATION TRANSPARENCY IN THE SUPPLY CHAIN IS A RISK TO SUPPLIER RELATIONSHIPS AND OPERATIONAL STABILITY.

Software technology is capable of providing solutions to these issues. If existing solutions don’t meet the needs, a custom solution may need to be designed, taking into account all areas of deficiency. For example, an artist should be able to access an overview of his/her song/album statistics (streams, downloads, etc.) and incoming payments as well as data analytics-based reports and charts showing geographical fan concentrations, popularity of individual songs across various demographics, etc.

In the near term, the music industry can only meet its goals by achieving a more symbiotic relationship with its partners; a relationship supported by all applicable laws. In situations where the industry cannot reach an understanding, the only fallback available is to pull licensing from errant partners (per Taylor Swift’s 2014 decision to remove all her music from Spotify). That may be a double edged sword for artists with less stature, given the level of co-dependency and could materially hurt industry prospects for revenue growth.

Future growth opportunities

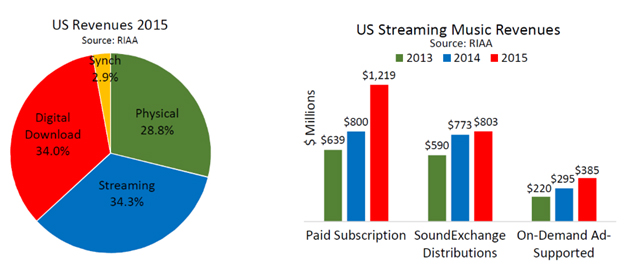

The music industry ecosystem is shown in Figure 3. Internal functions are at the bottom of the figure (talent search, etc.) and sales channels are shown in the branches/leaves of the tree.

Source: Recording Industry Association of America

Figure 3: The Music Industry Ecosystem

Channels shown should be subjected to a review of revenue growth in recent years, pain points and technology modernization. For example, consider broadcast radio. This medium is completely ad-supported and has not diminished in popularity even with the emergence of satellite and internet radio. However, advertising revenues are under pressure as marketers divert advertising dollars to interactive web and mobile platforms which enable ROI measurements. Although satellite and internet radio are now increasingly available in newer car models, they are subscription-based and carry national advertising but not local news and ads as do local radio stations. For these and other reasons, over 90% of auto owners across different demographics listen to FM/AM radio stations for more than 12 hours per week.

If we assume that healthy revenues in the broadcast radio industry are beneficial for the music industry, the challenge is to enable interactivity while continuing to leverage the existing radio networks, stations and infrastructure. In addition to advertiser benefits, this could open up a variety of new interactive services for car owners, including location-specific services.

Numerous patents exist to do precisely what is described above, by leveraging RDS (Radio Data System) data fields embedded within conventional FM radio broadcasts. Companies like Sony-Ericsson, Apple and many others have a host of patents dating as far back as 2002, explaining how RDS information can be used in conjunction with a mobile phone, to leverage a media server to access interactive services in a car including ads, music, miscellaneous purchases, discounts/coupons, call center support, etc. Surprisingly, these ideas have not yet been commercialized and represent an opportunity waiting to be pursued by the right company.

BIG DATA AND NEW SERVICE REVENUES

In every industry today, executives are faced with tough decisions around the definition of their core business and how this might change in future as technology permeates the business and its value chain. The challenge in many cases is one of identity – do we become more software-centric or do we allow software companies to take over large pieces of our current and future value chains? User data aggregation, big data analysis and predictive analytics are key technologies for the future and are at the heart of this discussion, along with the possibility of creating new revenue generating customer services which leverage this data.

Historically, the music industry has focused exclusively on the creative aspect of music and partnered with companies like Apple, Spotify and Google for user provisioning, music delivery, user experience, billing, customer relationship management and other functions. The principal advantages are the ability to delegate a variety of risks including the technology, financial, marketing, customer management and other operational risks to a third party, in exchange for a cut of the revenues. Prior disadvantages include a reduction in the size of the addressable market by sacrificing the monetary value and control implicit to these functions, the dependency on external partners to meet goals and the need to contractually manage these relationships. An additional disadvantage in the context of data is the loss of ability to collect and leverage data to build new consumer services and improve existing ones, provide more value to artists in the form of market intelligence, etc.

Vertical integration remains an option (in coopetition with current partners) either by acquisition (Tidal is currently for sale and Pandora may soon follow suit) or by organic buildout. Success will require long term management commitment and funding for hiring, capability building and learning from mistakes. The advantages are the ability to better shape the future and to create new services within the ecosystem. If building or bringing these capabilities in-house is not an option, the industry should negotiate access to capabilities available from its technology partners..

User data aggregation, big data analysis and predictive analytics are key technologies for the future. If building these capabilities in-house is not an option, the industry should negotiate access to capabilities available from its technology partners.

MOBILITY, SPEED AND NEW SERVICES

With FCC backing for 5G via release of new spectrum in July 2016, and the trials underway at telecom companies across the country, higher speeds (at least 10 Gbps, which equals 60 to 70 times faster than 4G speeds at 150 Mbps) could be here between 2017 and 2020. This opens up the possibility for a host of new applications in the home, office and car with new ways to create, package and deliver high quality music and video streams wirelessly and near instantaneously.

Developments in augmented reality and virtual reality may also provide opportunities to present music in new and different ways, either standalone or in conjunction with other services and new devices being built to commercialize these services.

Author’s Note: A March 2016 McKinsey report entitled “The economic essentials of digital strategy from the perspective of supply and demand side analysis” includes a framework to enable analysis of disruptive threats and vulnerabilities. Deloitte and others have similar papers and reports published on their websites.

About the Author

Anand Divekar is a management consultant and provides technology and strategy consulting services to customers in telecom, software and other industries. He worked at Verizon’s R&D labs (mobile and broadband technologies), followed by Deloitte and Bearing Point Consulting, prior to founding Eco-Bridge.